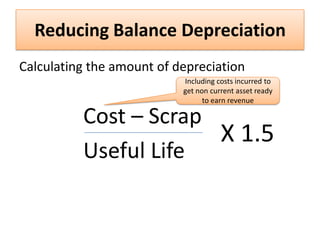

Diminishing depreciation formula

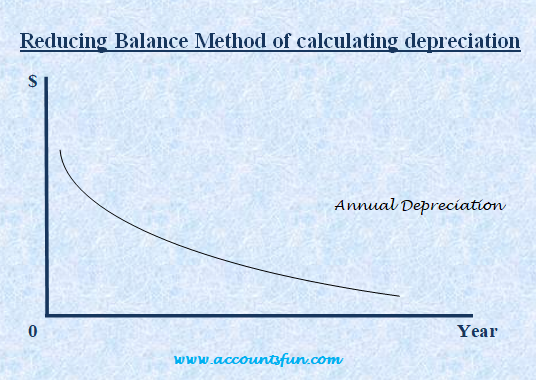

The diminishing balance method is a. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime.

Depreciation Formula Examples With Excel Template

Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States.

. Cost value diminishing value rate amount of depreciation to claim in your income tax return The. The double declining balance depreciation method is one of two common methods a business uses to account for the. Use this calculator to calculate an accelerated depreciation of an asset for a specified period.

Year 2 2000 400 1600 x. In this lesson we explain what the straight line and diminishing balance depreciation methods are show the formula for calculating the depreciation methods. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100.

2000 - 500 x 30 percent 450. Of depreciation days minus the number of days. Cost value 10000 DV rate 30 3000.

Year 1 2000 x 20 400. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Prime cost straight line method.

According to the Diminishing Balance Method depreciation is charged at a fixed percentage on the book value of the. The diminishing balance method is a method of calculating the depreciation expense of an asset for each accounting period. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this.

This method depreciates at a high rate for the start of an assets life and has a reducing rate. We still have 167772 - 1000 see first picture bottom half to depreciate. Example of Diminishing Balance Method of Depreciation.

Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. Depreciation formula diminishing value Friday September 9 2022 Edit. Diminishing Balance Method Example.

What is diminishing balance depreciation. In this video we use the diminishing value method to calculate depreciation. Calculator for depreciation at a declining balance factor of 2 200 of straight line.

In period 9 Depreciation Value DDB 33554. The diminishing balance method of depreciation or as it is also known the reducing balance method calculates depreciation as a percentage of the diminishing value. A depreciation factor of 200 of straight line depreciation or 2 is most.

If we use Straight line method this results in 2 remaining. Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years.

According to the Diminishing Balance Method depreciation is charged at a fixed percentage on the book value of the asset. As the book value reduces every. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows.

If you use this method you must enter a fixed. And the residual value is. Double Declining Balance Depreciation Method.

Diminishing Balance Method Example. On 01042017 Machinery purchased for Rs 1100000- and paid for transportation charge 150000- to install.

Using Spreadsheets For Finance How To Calculate Depreciation

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

1 Free Straight Line Depreciation Calculator Embroker

Double Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Straight Line Method Or Original Cost Method Lecture 1 Youtube

Straight Line Depreciation Method Youtube

Reducing Balance Method For Depreciation

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation All Concepts Explained Oyetechy

Depreciation Calculation

Declining Balance Method Of Depreciation Formula Depreciation Guru

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Method To Get Straight Line Depreciation Formula Bench Accounting

Double Declining Depreciation Efinancemanagement